will the salt tax be repealed

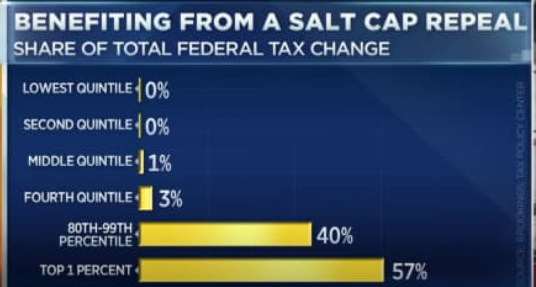

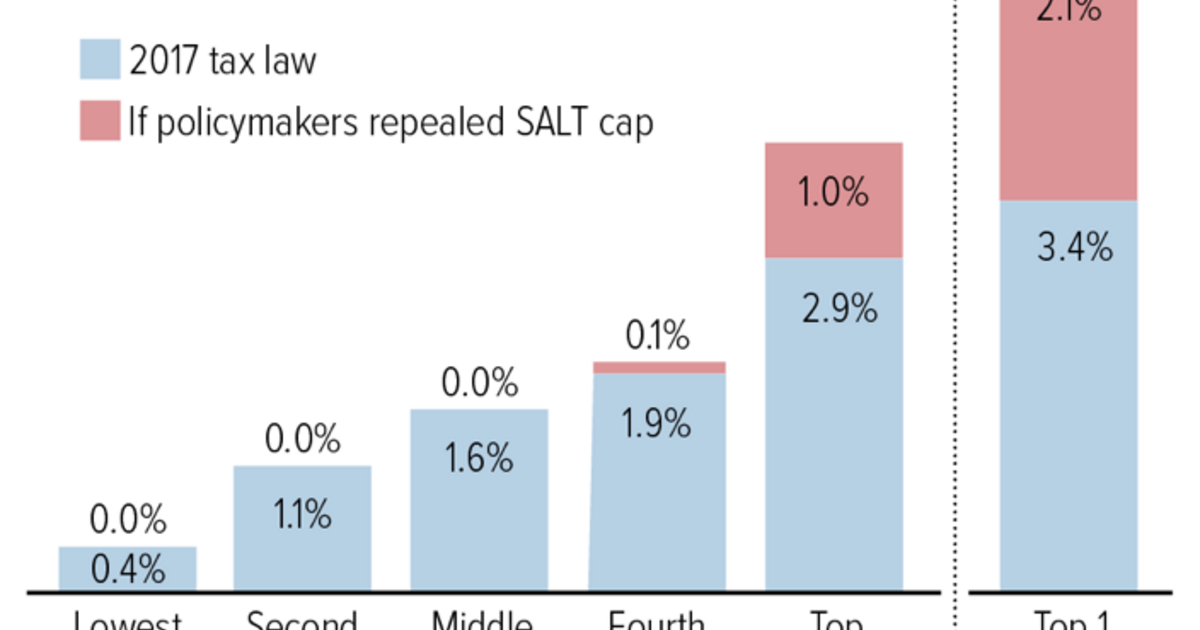

The plan reportedly would repeal the SALT cap for 2022 and 2023 only. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed.

Dems Don T Repeal The Salt Cap Do This Instead Itep

Lifting the SALT cap is good because blue states are donor states to red states.

. The 10000 cap would in theory resume in 2024 and 2025. According to press reports the Senate is considering repealing the 10000 cap on the state. Under the 2017 Tax Cuts and Jobs Act.

Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut. Joe Manchin D-WVa raised broader objections to President Bidens social spending and. If the cap were.

For tax years beginning on or after Jan. On Friday the Wall Street Journal reported that a repeal of the SALT caps that accompanied former President Donald Trumps 2017 tax cut bill is still possible. Some Democrats look into SALT tax deductions for 35 trillion spending bill.

A two-year SALT cap repeal. The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen.

A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging. A two-year SALT cap repeal. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. A new bill seeks to repeal the 10000 cap on state and local tax deductions. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

It is only fair for blue states who are net contributors to federal. 1 2021 nonpublicly traded partnerships with New Yorksource income can elect to be taxed at the partnership level NY. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

Two wrongs do not make a right. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing. In a nation where 87 percent of people already make too little to itemize their tax returns and are therefore not eligible for any SALT deductions Democrats whole campaign is.

Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only. Americans who rely on the state and local tax SALT deduction. The lawmakers have asked.

The Tax Foundation predicts that a full repeal of the cap. I-Vt blasted reports that a SALT repeal may be included in the family and climate spending. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut.

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. March 1 2022 600 AM 5 min read. SALT Cap Repeal Below 500k Still Costly and Regressive.

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Salt Deduction Cap Should Be Reformed Not Repealed Itep

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)